Bank reconciliation software

Bank reconciliation software

Request a demo

of ERFcheck

Functions of ERFcheck

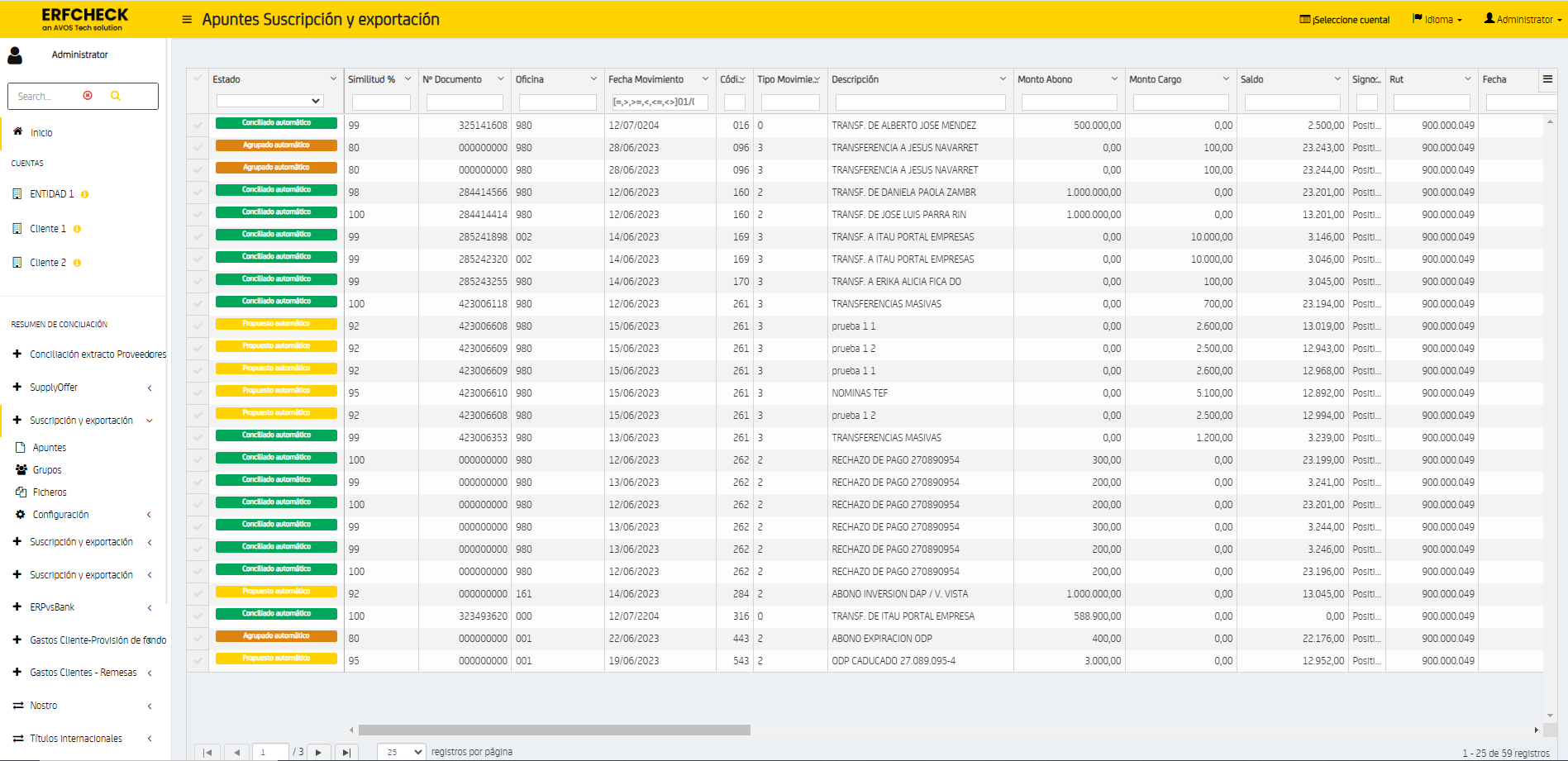

Thanks to a sophisticated level of automation in the bank reconciliation process, financial and management control departments in banking institutions can access a single front-end with a unified, consolidated view of all transactions.

They can consult a review of automatically reconciliated entries, manual resolution of unresolved items, access to processed transactional history.

Therefore, ERFcheck stands out as one of the most efficient bank reconciliation programs – minimizing errors, optimizing time and costs, and reducing operations, regulatory, and reputational risks.

Benefits of ERFcheck

Comprehensive visibility into financial information

Fewer errors and discrepancies

Full transparency in the reconciliation process

Focus on high-value tasks

Cost savings and risk mitigation

Characteristics of ERFcheck

Below are the advanced characteristics of ERFcheck for the reconciliation process, where its cutting-edge technology ensures a comprehensive and effective approach.

Reconciliation process optimization and efficiency

The use of ERFcheck replaces the old and complex manual processes that various companies use to carry out reconciliation. Thanks to bank reconciliation, the automation of this process allows finance departments to validate, enrich, and reconcile data throughout the lifecycle of a transaction with full visibility and complete transparency for the organization.

Flexible Platform Tailored to Client Needs

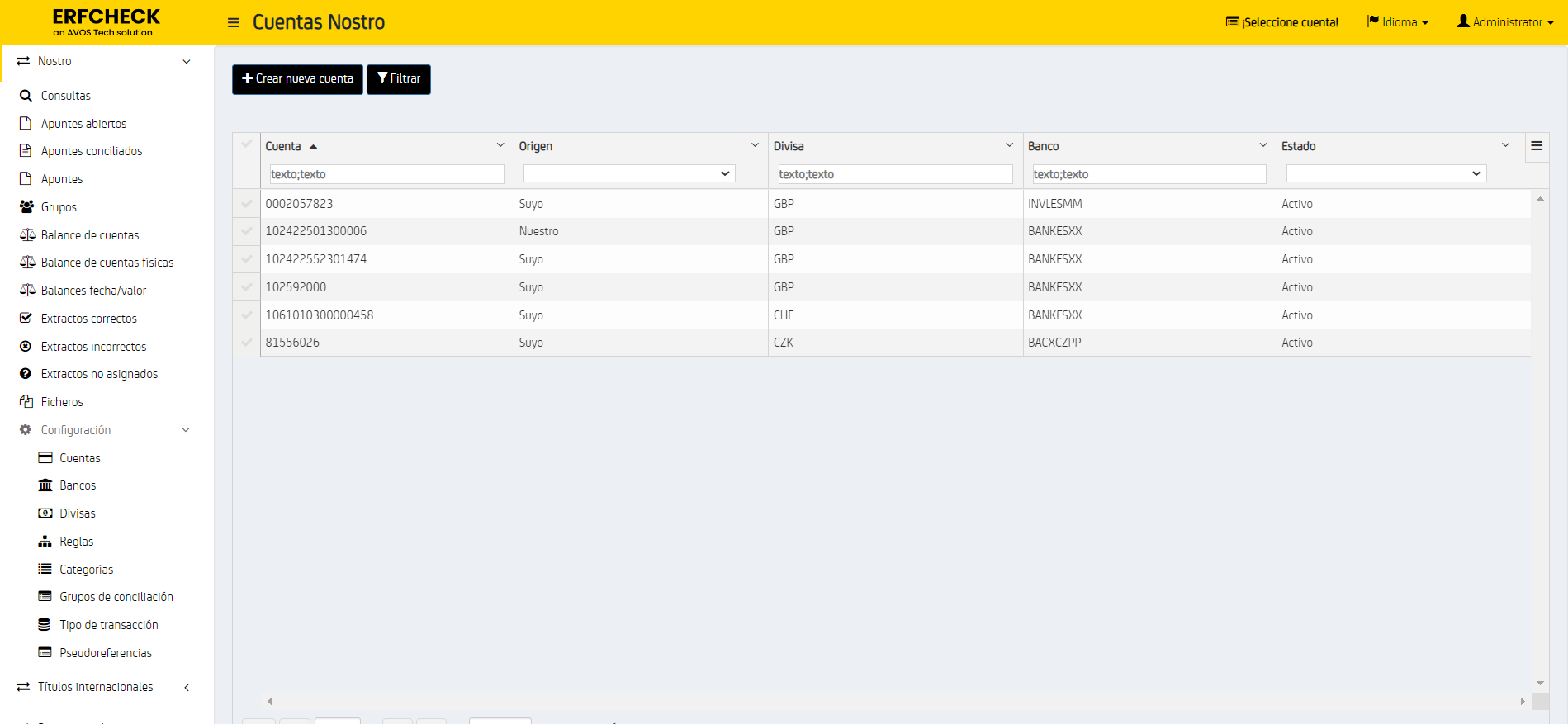

ERFcheck supports various types of reconciliations (FoBo, Nostro, Securities, Snapshot, etc.). In the same way, the reconciliations can be configured form any interface format or reconciliation rules - meeting standard market formats. Users can define ranges and tolerances, set access permission by entity or department, and even import organizational structures from external systems.

Powerful Technology for High Volume Data Handling

ERFcheck is a modular, scalable, and configurable system that differs from other reconciliation platforms. Through the combination of business intelligence, rule process, and Big Data, ERFcheck is as powerful as it is easy to use. The user simply needs to access the software through a cross-platform web system. In addition, ERFcheck enables full integration with banking and operational systems, ranging from any type of core banking systems to management platforms such as ERP’s or CRMs.

Success Case of ERFcheck

How we have helped, through ERFcheck,

to optimize more than 300 bank reconciliations at a global financial institution.

Outsourcing the AML/CFT Technical Unit

At AVOS Tech, we offer an outsourcing service for control and monitoring defined for each obligated entity. We help companies comply with current AML/CFT regulations through our Compliance BPO team.

.png)